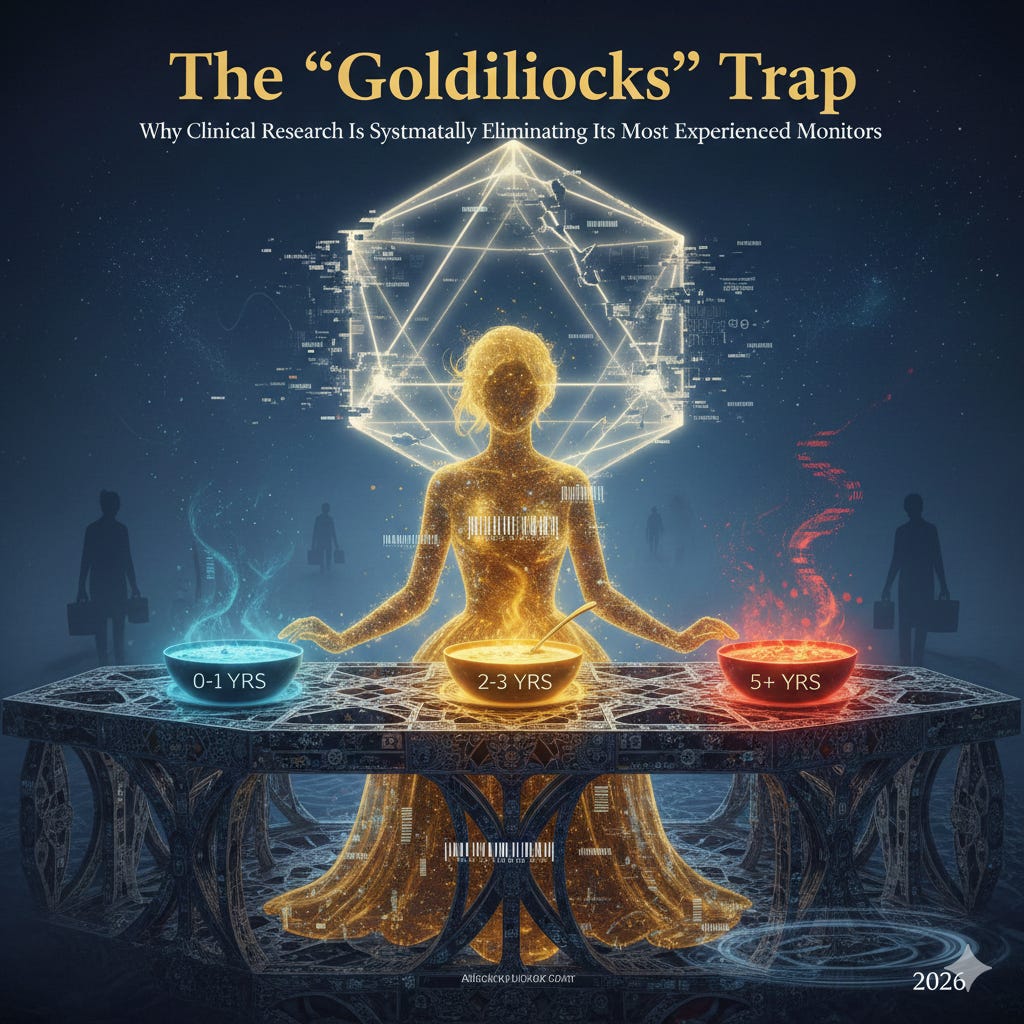

The “Goldilocks” Trap: Why Clinical Research Is Systematically Eliminating Its Most Experienced Monitors

If you’ve been in clinical monitoring for more than five years and feel like you’ve suddenly become unemployable, you’re not imagining it. Multiple people from Guru Nation have reached out to me about this. When enough of you tell me the same pattern, my spidey senses go up. An n of one means anything can happen. But when the pattern repeats? There’s something there.

So I put my analysts to work: Gemini Deep Research, Claude Opus, and a sprinkle of Grok. We compiled evidence from over 100 sources. And what we found is deliberate, systematic, and appears to be the new normal for the time being.

The industry has engineered a preference for CRAs with exactly 2 to 3 years of experience. It’s not about your skills. It’s about margin optimization.

The Evidence Is Right There In The Job Postings

Here’s what recruiters are posting on LinkedIn right now:

“Sponsor company seeking to hire CRA with just 2-4 years of on-site monitoring experience.”

“Hiring contract CRAs in Texas for large CRO. Seeking 2-3 years of monitoring experience. Not seeking monitors with 5+ years.“

Read that again. They’re literally excluding experienced candidates in the job requirements. This has never happened before. We used to say the more experience you have, the better. That era is over.

The Economics Are Brutal And Deliberate

Here’s the uncomfortable truth: CROs view you as a unit of labor, and they’ve done the math. The fundamental business model of the CRO industry has always been labor arbitrage. They purchase clinical expertise in the form of a salary and sell it to pharmaceutical sponsors in the form of a billable hour. Their profitability depends entirely on the spread between these two numbers.

I’ve been in bid defenses and RFPs as a CRO executive (albeit a tiny one but I’ve been in those conference calls). Sponsors line-item everything. They’re always asking what differentiates you from the others, and how much lower can you go on the billable hourly rate.

Labor costs for experienced staff surged following the Great Resignation and the post-pandemic demand spike. Those were good times to be a CRA. Salaries for Senior CRAs (5+ years) in North America historically trended between $130,000 and $160,000. Add signing bonuses and retention incentives, and total compensation pushed even higher.

But the billable rates that pharmaceutical sponsors are willing to pay have not scaled in tandem. Large pharma companies face patent cliffs and pressure to reduce R&D costs. They need budgets for merger and acquisition frenzies. This creates a rate ceiling for what they consider the necessary evil of a CRO. And with more CROs merging and consolidating, technology became the deflationary force. The more competition, the tighter the margins.

The calculation breaks down like this:

Entry-level CRAs (0 to 1 years): Financial drain. They require significant non-billable training time, close supervision, and co-monitoring visits where you’re paying two salaries but only billing one unit. They’re an investment with delayed returns. CROs aren’t willing to make those investments right now. They’re making those investments in tech, just not in human resources. The one exception may be experienced clinical research coordinators with bachelor’s level degrees or higher. That speaks volumes.

Senior CRAs (5+ years): Margin killers. If a CRO bills a sponsor $250/hour for monitoring, and the Senior CRA costs $100/hour in salary plus $40/hour in overhead and benefits, the margin is compressed. Your $145K salary plus benefits eats 60 to 70% of the billable rate, leaving razor-thin profits. This does not tend to scale well.

The Goldilocks Zone (2 to 3 years): Maximum profitability. Fully autonomous, requiring no hand-holding or non-billable supervision. Fast enough to meet utilization metrics. Most importantly, their salary (typically $100K to $120K) fits comfortably within standard billable rate structures, allowing the CRO to maximize EBITDA.

You’re not being rejected because you lack competence, but because you’re too expensive for a commoditized service where sponsors refuse to pay a premium for wisdom over efficiency. We are officially in the “knowledge is free” era.

The FSP Model Turned Experience Into A Mathematical Liability

One of the things driving this rigidity is the industry’s migration toward the Functional Service Provider model over the past decade. Unlike traditional full-service outsourcing where a CRO is paid for deliverables like a site initiation visit, the FSP model is essentially a staffing arrangement. Sponsors contract for specific roles (heads in beds) to integrate into their own teams.

FSP contracts are governed by rigid rate cards that define bands of experience. A typical FSP contract might define a “CRA II” as having 2 to 4 years of experience and assign a fixed hourly rate to that role. This contract structure removes all flexibility from the hiring manager.

If a hiring manager in an FSP unit identifies a brilliant candidate with 7 years of experience who is willing to take the job, they are often contractually or financially barred from hiring them. Here’s why:

The procurement teams at sponsor companies strictly control the headcount budget. They allocate budget for 50 “Level 2” monitors. If the CRO hires a Senior monitor for one of those slots, the CRO must pay the Senior salary but can only bill the sponsor at the “Level 2” rate. This results in a direct loss for the CRO on every hour that employee works.

Consequently, “overqualification” is not a judgment of personality. It’s a mathematical fact within the FSP framework. A candidate with 10 years of experience is a square peg for the round hole of a Level 2 budget line item. The FSP model effectively imposes a hard ceiling on experience for high-volume roles, creating a market where accumulating too much experience renders you unemployable for the vast majority of open positions.

There is now over-qualification in this industry at the CRO level, which was never the case before. The ironic thing is sponsors complain, especially the small sponsors. They complain that their CRAs are not knowledgeable, and now they’re going out of their way to make sure they’re not knowledgeable enough. Or maybe just knowledgeable enough to save money.

Private Equity And The Efficiency Imperative

The consolidation of the CRO market (Fortrea, Syneos, IQVIA, Icon, MedPace) has brought with it the financial discipline of private equity and public market shareholders. These ownership structures prioritize efficiency metrics over clinical redundancy.

In the private equity worldview, labor is a fungible asset. The goal is to standardize the input (the CRA) to ensure a predictable output (monitoring data) at the lowest possible cost.

The primary metric for CRA performance is utilization: the percentage of working hours that are billable to a client. This is why CRAs complain about their workload and are experiencing burnout in droves. Senior CRAs, with their wealth of experience, often push back against excessive utilization targets (which can reach over 100% capacity). They may demand time for mentoring, quality control, or complex site relationship management. These are valuable activities, but they’re not billable.

Junior CRAs (2 to 3 years) lack a reference point for what constitutes a reasonable workload. Especially right now, they’re just happy to have a job, eager to advance, and more compliant with high utilization demands. They’re not experienced enough to push back and not experienced enough to command higher salaries, which is perfect for the CRO. They’re less likely to push back against aggressive travel schedules or demand days off.

For a CRO, the 2-year CRA is a more efficient unit of production than the 15-year veteran who asks difficult questions about protocol safety or site burden. Everything we used to deem as good (pushing back because you’ve seen things fail and you want to prevent that from happening in the future) used to be looked upon as an asset. Not anymore.

Follow industry analysts like Joel White. He’ll tell you CROs are at record high profits. But at the same time, I think they’re going to be losing market share to site networks over time. The writing’s on the wall.

Global Labor Arbitrage

The “Goldilocks” trend is further complicated by globalization. The salary bands I mentioned apply largely to North America and Western Europe. But CROs operate globally.

Here’s what Senior CRA salaries look like converted to US dollars:

North America: $145,000+ (hiring freeze, layoffs)

Western Europe: $110,000 to $130,000 (stagnant, FSP only)

Eastern Europe: $60,000 to $80,000 (active hiring)

Asia Pacific (India): $30,000 to $50,000 (aggressive expansion)

This creates a bifurcated market. High-volume, standard monitoring tasks are increasingly being offshored or assigned to lower-cost regions where remote monitoring is possible. For the US and EU market, the remaining roles are strictly cost-controlled, squeezing out the expensive Western Senior CRA in favor of the mid-level domestic monitor who is just experienced enough to be legally compliant but cheap enough to compete in a globalized cost structure.

As a site, I’m seeing this with the departments at the CRO that I have to invoice. They’re almost always in Eastern Europe or India or Latin America. Project managers now are from Latin America. It’s good for those regions, but if you’re a job seeker in the United States or Western Europe, you’re struggling right now.

The Algorithm Is Screening You Out Before Humans See Your Resume

The economic preference for mid-level staff is enforced operationally by technological gatekeepers. The modern hiring funnel is no longer human-centric. It’s algorithmic. Applicant Tracking Systems (ATS) and Human Capital Management platforms like Workday have operationalized the bias against experience, often automating the rejection of senior candidates before a human eye ever reviews their credentials.

Let me repeat that part again because if you’re confused about what’s happening, you’re thinking like a decade ago or even five years ago. Platforms like Workday have operationalized the bias against experience, often automating the rejection of senior candidates before a human eye ever reviews their credentials.

The recent class-action litigation Mobley v. Workday provides a window into the black box of automated hiring. The lawsuit alleges that AI-driven screening tools systematically discriminate against older candidates (and by proxy, experienced candidates) by using “years of experience” as a negative predictive factor for retention.

The algorithmic logic:

Pattern Recognition: The AI models are trained on historical data sets containing millions of hiring records. The system identifies correlations between candidate attributes and tenure.

The Retention Bias: Historical data often shows that candidates with 10+ years of experience who accept mid-level roles tend to resign sooner than candidates with 2 to 3 years of experience. They may leave for better offers, higher pay, or out of frustration with being managed by less experienced staff.

Predictive Filtering: To maximize “Hire Quality” (defined as retention and offer acceptance), the algorithm downgrades or automatically rejects candidates whose experience exceeds the “Goldilocks” band. The system views the Senior CRA not as an asset, but as a high-probability turnover statistic.

This creates a self-fulfilling prophecy. Senior candidates are rejected for being “flight risks,” forcing them to remain unemployed or consult, which creates gaps in their resumes that the algorithms also penalize.

We are now completely flipped as a workforce where it’s a liability to have years of experience. Let that sink in.

Beyond complex AI, simple keyword matching in ATS platforms (Taleo, BrassRing, Workday) creates structural barriers for senior candidates. A Senior CRA whose last title was “Principal Site Manager” may be filtered out when applying for a “CRA II” role because the system’s taxonomy does not recognize the downward move as valid. The system looks for linear progression. A step back is flagged as an anomaly or an error.

Job descriptions heavily weighted with keywords like “tech-savvy,” “digital agility,” “virtual monitoring,” act as proxies for age. While illegal to screen by age, screening by “digital adaptability” is common. Senior resumes that emphasize “thoroughness,” “relationship building,” and “SDV” score lower than junior resumes packed with tech-stack keywords.

The Operational Shift: From Intuition To Algorithm

The devaluation of experience is also a symptom of a profound shift in how clinical monitoring is performed. The industry has moved from a model reliant on human intuition and on-site presence to one driven by data analytics and remote oversight.

Source data verification has always been easy. I was always amazed they didn’t just automate it. Matter of fact, that’s an outdated term already. Source data review automation? We’re basically here. That came faster than I thought. I’m an advisor for a couple companies that have the capability of essentially automating monitoring, at least the task-related aspects. There are human factors as well that can’t be automated, but we’re in this weird transition period.

The adoption of Risk-Based Quality Management (RBQM) has fundamentally altered the CRA’s mandate. In the traditional model, the CRA was the primary detector of errors. In the RBQM model, a central data analytics system identifies outliers, anomalies, and potential risks. The field monitor’s role has shifted from “Investigator” to “Executor.” The system flags a specific patient or data point, and the CRA is dispatched to check that specific item. This requires less clinical judgment and more operational compliance.

Because the “thinking” is increasingly done by the central algorithm, the “doing” can be assigned to less expensive labor. A CRA with 2 years of experience can verify a specific data point just as well as one with 20 years. The premium paid for the Senior CRA’s ability to “sense” a problem is nullified when the software does the sensing.

The AI projection is stark: It’s projected that by 2028, between 40% and 60% of routine monitoring tasks (basic source data verification and query generation) could be partially automated. The traditional CRA role is being de-skilled in real time.

The proliferation of Decentralized Clinical Trials (DCTs) has further detached the monitor from the site. With patient data coming directly from wearables or home health visits, the traditional relationship-based monitoring (where a Senior CRA bonds with the study coordinator to ensure compliance) is less relevant. The primary skill set for DCTs is the ability to navigate complex digital ecosystems. The industry perception, fairly or unfairly, is that CRAs in the 2 to 5 year window are at the peak of their technological adaptability. They’re experienced enough to understand the protocol but young enough to instinctively navigate new software interfaces.

Senior CRAs are often stereotyped as requiring more IT support and training to master these ever-changing platforms, making them less attractive in a fast-paced DCT environment. I’ve always been asked, is there ageism in research? At the monitoring level, my answer has always been no. But I think in 2026, I need to change my answer.

The Rise Of The Assistant Infrastructure (And What It Means For You)

As the CRA role becomes squeezed into the Goldilocks zone, there’s been a simultaneous professionalization of the support infrastructure. Clinical Trial Assistants (CTAs), Site Management Associates (SMAs), and the traditional Clinical Research Coordinators (CRCs) now form the operational backbone of modern trials.

Here’s what’s happening: as CRAs are pushed toward high-level oversight (at least in theory), the daily administrative and site-facing logistics are being delegated to this specialized support tier. These roles function as the “stage managers” of the research process.

Clinical Trial Assistants (CTAs): The organizational backbone, typically working for the sponsor or CRO remotely. Their primary focus is the Trial Master File (TMF), the comprehensive repository of every document required for regulatory approval. CTAs are effectively mini-operations managers keeping ethics submissions and TMF completeness on schedule. This is a common entry point for life science graduates. Salaries range from $45,000 to $75,000.

Site Management Associates (SMAs): A newer specialization designed to reduce the administrative burden on both CRAs and trial sites. Positioned between the CTA and the CRA, the SMA combines site interaction with operational support. Unlike CRAs, SMAs don’t typically perform on-site monitoring or source data verification. Instead, they communicate directly with sites to review essential documents, track site-level activities, and ensure the site is “inspection-ready.” By handling constant follow-up for missing documentation and training records, the SMA allows the CRA to focus on high-risk monitoring.

Clinical Research Coordinators (CRCs): The backbone of research at the hospital or clinic level, working directly under the Principal Investigator. While CRAs work for the sponsor or CRO to ensure compliance from the outside, the CRC manages day-to-day operations from the inside. Their responsibilities are patient-facing: screening subjects, obtaining informed consent, coordinating clinic visits, processing lab samples, entering data into EDC systems. Salaries range from $50,000 to $95,000.

Why this matters for displaced Senior CRAs: These assistant roles are not subject to the same Goldilocks constraints. Site networks in particular are hiring experienced professionals into CRC and operational leadership positions. If you can’t get hired as a CRA, the CRC route at a professional site network might be your bridge back into the industry. The synergy between these roles drives trial efficiency, and smart professionals are recognizing that lateral moves into these positions preserve your career while the CRA market sorts itself out.

We’re Watching The Consequences Play Out In Real Time

While the “Goldilocks” strategy appears rational on a balance sheet, the removal of deep experience from the front lines of clinical research is generating severe, tangible risks. The industry is witnessing a “juniorization” of oversight that is directly correlated with a rise in regulatory failures, undetected fraud, and operational friction.

This is going to be one of the panels at SOS Save Our Sites. The FDA panel. We’re going to get into it so you can hear firsthand yourself.

The most damning evidence of this trend’s failure is found in the FDA’s enforcement logs. A review of BIMO (Bioresearch Monitoring) inspection metrics and warning letters from 2024 to 2025 reveals a persistent spike in citations for inadequate monitoring. This is a relatively new thing. We start seeing the spike in 2024. The 2025 to 2026 data hasn’t come out yet. It’s going to be worse.

Warning letters frequently describe scenarios where monitoring visits occurred regularly, yet critical deviations (enrolling ineligible patients, failure to report SAEs) went undetected for months. I’ve personally witnessed monitors come in, sign the monitoring log, and then leave and go to the beach. It happens.

We’ve turned into a checklist mentality. Inexperienced monitors, driven by utilization metrics and lacking clinical confidence, often focus on low-value administrative findings (a missing signature on a log) while missing high-value safety signals (a pattern of adverse events that suggests a toxicity issue). Talk to any biotech that’s willing to speak. They’re going to tell you the same thing. It’s no wonder these sponsors are going more towards in-house as much as they can.

The FDA’s frustration with inadequate monitoring is effectively a critique of the “Goldilocks” workforce’s inability to see the forest for the trees.

The Epidemic Of Clinical Trial Fraud

Perhaps the most alarming consequence of replacing seasoned monitors with junior staff is the industry’s vulnerability to sophisticated fraud. There’s a very famous case right now with a CRO of all companies, an angry sponsor, and a few sites committing fraud. I’ve done hours on this series, but just go to my channel and check it out.

Diversion schemes: There’s been a rise in the diversion of controlled substances and expensive investigational products (HIV drugs, Adderall). Detecting diversion requires a monitor to look beyond the dispensing log. It requires auditing pharmacy inventory, checking for forged chain-of-custody documents, and cross-referencing patient visits with dispensing dates. An inexperienced monitor, intimidated by a Principal Investigator or rushing to catch a flight, is far less likely to conduct this deep-dive forensic audit than a confident Senior CRA.

Fabricated data and “ghost” patients: In the age of remote monitoring, fake patient data can be generated. Detecting this requires intuition: noticing that the timestamps on eDiaries are implausibly regular, or that the “voice” of the patient in subjective assessments sounds identical across multiple subjects. Senior CRAs, who have seen thousands of real patients, have a baseline for “normal” that junior monitors lack. The Goldilocks monitor accepts the data if it falls within the validated range. The Senior monitor questions the data if it looks “too perfect.”

The Site Network Backlash

The rise of “Super Sites” (large, PE-backed site networks like Velocity Clinical Research and Flourish Research) has shifted the power dynamic. These networks employ highly professionalized staff, often with more experience than the monitors sent to audit them. Sometimes they hire these out-of-work Senior CRAs.

When a CRO sends a 2-year CRA to monitor a site network run by a Director with 15 years of experience (and a QA person who was a Senior CRA at three different companies), conflict is inevitable. The junior monitor may issue queries that are technically incorrect or operationally naive.

This leads to “Query Ping-Pong,” where sites reject the monitor’s findings, leading to rounds of arguments that delay database lock. Sponsors get this feedback and question why they are using a CRO in the first place.

Banning junior staff: Industry intelligence suggests that some high-leverage site networks are beginning to dictate terms to CROs, refusing to work with specific monitors or demanding Senior staff for complex protocols. They’re playing hardball. You guys think the article I wrote with that ostrich with his head in the sand was just to get clicks? These networks are happily going to the sponsor and complaining. Save Our Sites is kind of a platform for that. It’s not meant for site networks necessarily, but they come. They’re putting pressure on the CROs too.

This creates a market pressure that CROs, with their hollowed-out senior ranks, are struggling to meet. The quality of the partnership between sponsor, CRO, and site can determine the success or failure of a study. High-performing CROs distinguish themselves by adopting site-centric processes that reduce operational burden. Features like real-time query support, early collaboration in protocol development, and the assignment of a consistent CRA to a site reduce fragmentation. But when you’re cycling through inexperienced monitors every few months, that continuity is impossible.

The Regulatory Environment Is Changing (And It’s Not Helping)

The finalization of ICH E6(R3) in January 2025 marks the most significant changes to Good Clinical Practice in over a decade. This revision shifts regulatory focus away from exhaustive documentation toward a “Quality by Design” approach that is proportionate to the level of risk involved in a trial.

The core of E6(R3) is the identification of Critical-to-Quality Factors (CtQFs) that directly impact participant safety and data reliability. Rather than verifying every single data point (a process that has become unsustainable), E6(R3) encourages sponsors and CRAs to focus resources on the most critical elements of the study.

For the CRA, this means a shift in responsibility from routine task-checking to a “culture of quality” focused on proactive risk management. Monitors are now expected to perform data trend analysis and lead corrective and preventive actions (CAPAs) rather than just identifying errors after they’ve occurred.

Here’s the problem: this requires judgment, pattern recognition, and clinical confidence. Exactly the attributes that come with experience. The regulatory environment is demanding more sophisticated oversight at the exact moment the industry is systematically eliminating the professionals capable of providing it.

The catch-22 is brutal. E6(R3) also reinforces patient-centricity as a core principle, requiring documented evidence of equitable participation and transparent communication. This creates demand for roles like “Patient Safety Advocate” and “Diversity and Inclusion Strategist.” But these specialized positions require deep clinical research experience to be effective. You can’t advocate for patient safety if you don’t understand the complex interplay of protocol design, site burden, and regulatory compliance.

The Survival Playbook

For clinical research professionals, the implications are clear: the era of the generalist career CRA is effectively over. To survive and thrive in a market that penalizes tenure, you must actively engineer your career to bypass the “Goldilocks” filter.

It sucks, but there are things you can do about it, and it’s not going to change anytime soon. Also, generalists will be more valuable than ever, but as independent contractors in my opinion.

Beat The Algorithms

To navigate the hostile ATS landscape (Workday, Taleo), senior candidates must fundamentally restructure how they present their experience. The goal is to appear current and relevant rather than historic.

The Relevance Window: Truncate the resume to the last 10 to 15 years. Experience prior to 2010 is often viewed by algorithms (and bias) as obsolete. Remove graduation dates from degrees to mitigate age-based filtering.

Title Calibration: If applying for a CRA role, align your title with the Goldilocks expectation. If your last title was “Senior Principal Lead Monitor,” but you’re willing to do the work of a Senior CRA, consider simplifying the title on the resume to “Clinical Research Associate.” I would go a step further and just take the “Senior” out. This prevents the overqualified flag from triggering automatically.

Keyword Injection: These systems scan for high-value keywords. Ensure your resume contains:

Systems: Veeva Vault, Medidata Rave, Oracle Inform, Workday, CTMS, eTMF (Florence), Crio, Medrio

Methodologies: Risk-Based Monitoring (RBM), Remote Monitoring, Decentralized Clinical Trials (DCT), Source Data Verification (SDV), Good Clinical Practice (GCP), RBQM, eSource, ePRO, eCOA

Emerging tech: AI-powered monitoring, Machine Learning, Data Analytics, eConsent platforms

Strategy: Contextualize these keywords. Instead of a list, write: “Implemented Risk-Based Monitoring strategies using Veeva Vault to reduce on-site SDV by 30%.”

Metrics Over Tenure: Replace “20 years of experience” (which signals cost and age) with value metrics: “Managed 3 sites to zero FDA findings,” “Reduced query resolution time by 40%,” “Led CAPA implementation resulting in 95% first-pass inspection rate.” Metrics are ageless. Tenure is a liability.

The Specialist Pivot: The Safe Harbors

The “Goldilocks” cap dissolves in high-complexity therapeutic areas where safety risks are paramount and junior staff are a liability.

Cell & Gene Therapy (CGT): This is the highest-value sanctuary. The FDA just came out and said they’re trying to incentivize more US-based cell and gene therapy, rare disease, ultra-rare disease type of studies. You’re going to expect to see a lot more of those coming from small biotechs. I happen to be invested in one right now. They’re about to have a PDUFA. It’s a cell and gene therapy for an ultra-rare disease.

CGT trials involve complex logistics (apheresis, cold chain management, CAR-T infusion) and extreme safety risks (Cytokine Release Syndrome). A 2-year CRA cannot manage these risks. CROs must hire senior staff for these roles. Obtaining experience or certification in this niche provides immunity to the generalist trend.

Oncology (Early Phase): Phase I Oncology requires intense oversight and real-time safety monitoring. Oncology continues to dominate the global research landscape with nearly 1,000 planned trials annually, each requiring rigorous protocol adherence and meticulous data verification. The margin concerns of the CRO are secondary to the safety risks. This remains a stronghold for experienced monitors. This is usually where you’ll see registered nurses and international medical graduates. They’re usually put on these kinds of trials because they have strong clinical knowledge.

Rare Disease Trials: These studies present unique challenges in patient recruitment and endpoint validation. They often rely heavily on Patient-Reported Outcome Measures (PROMs) and require coordinators who can manage decentralized networks reaching into patients’ homes. The expertise required here favors experienced professionals who understand the nuanced relationship between patient advocacy and clinical rigor.

Advanced Certifications: Earning designations like CCRA (Certified Clinical Research Associate) or CCRP (Certified Clinical Research Professional) from ACRP or SOCRA signals professional commitment that differentiates you from the transient gig worker. Roughly 70% of companies now require these certifications for advancement. I think those are probably worth your while too.

Change Sides: Poacher Turned Gamekeeper

If CROs refuse to hire senior staff, the most effective strategy is to move to the entities that manage the CROs.

Sponsor Oversight Roles: Pharmaceutical sponsors are keenly aware that CROs are using junior staff. Matter of fact, they’ve been complaining about it anecdotally to me, and I know they’re complaining to other people for the last five years. The smaller sponsors first, but now even the big sponsors are complaining.

To mitigate this risk, they hire experienced professionals internally to “monitor the monitors.” Roles like “Clinical Operations Lead,” “CRA Oversight Manager,” or “Clinical Trial Manager” at a sponsor require deep experience to audit the CRO’s performance. Salaries for Clinical Trial Managers range from $110,000 to $215,000. Director of Clinical Operations positions command $160,000 to $300,000. The “baggage” of the Senior CRA (knowing exactly where the bodies are buried) becomes your greatest asset in these roles.

Site Management Leadership: As site networks professionalize, they need Directors of Clinical Operations. A Senior CRA understands exactly what sponsors want and can train site staff to be audit-ready. This role offers stability, no travel, and leverages the full weight of 15+ years of experience. Site networks are actively hiring experienced CRAs into coordinator and operational leadership positions because they need the competence mismatch to work in their favor when dealing with junior CRO monitors.

Medical Science Liaison (MSL): For those with advanced degrees (PhD, PharmD, MD), the MSL role plays a pivotal function at the interface between sponsor and investigative sites. As scientific representatives of pharmaceutical companies, MSLs engage with key opinion leaders and potential investigators. Their non-promotional role grants credibility needed to improve protocol comprehension and investigator motivation. This is a natural transition for experienced CRAs with therapeutic expertise.

Tech Vendors: Companies like Crio, Inato, Veeva, Real Time. There are so many vendors in this space. Just look them up. They need people who understand the operational reality. With AI and automation taking over 40 to 60% of routine monitoring tasks by 2028, emerging roles include Clinical Data Scientist, Digital Health Coordinator, Clinical Trial Technologist, and AI Specialist focused on protocol optimization. These hybrid positions require both clinical knowledge and data science proficiency.

Small Biotechs: I cover only small biotechs on my YouTube channel as far as publicly traded ones. They’re desperate for experienced people who can navigate regulatory complexity. The clinical research market is valued at over $70 billion as of 2024 and projected to maintain robust growth through 2028. Small biotechs can’t afford to gamble on inexperienced monitors for their pivotal trials.

The Consultant/Contractor Route

For those who wish to remain in monitoring, the 1099 Contractor (Freelance) model offers a bypass to the FSP salary bands.

The Rescue Premium: CROs and Sponsors turn to contractors when a study is in crisis (”Rescue Study”). In these situations, the budget constraints are loosened because the cost of failure (warning letter, rejected data) is existential. They need a fixer.

Contractors with 15 years of experience can command high hourly rates ($120 to $150/hour) to clean up the mess left by the 2-year CRAs. The Goldilocks CRA is for the steady state. The senior contractor is for the crisis.

I’ll give you a personal example. The last contract role I had was in 2020, and it was a rescue situation. They literally asked me to name my price within reason. This was during the hiring frenzy too. They asked if I had experience in this particular therapeutic area. I signed a CDA, they sent me the protocol, and they told me to schedule my visit for next week at the site.

They’re expecting somebody like a go-getter who’s able to solve problems on their own, doesn’t need hand-holding, knows where the bodies are buried. The fact that I had site experience for sure helped me. But if you have CRO experience and you’re entering into a rescue site, you’re going to have CRA experience as well too.

The PhD Advantage (If You Have It)

If you have a doctoral degree (PhD, PharmD), you’re in a unique position. The integration of PhD-level scientists into clinical research reflects a broader industry trend toward therapeutic specialization. As pharmaceutical sponsors move toward precision medicine for niche patient populations, the need for monitors who can engage with Principal Investigators on a peer-to-peer scientific level has become critical.

Doctoral graduates bring technical expertise that allows them to oversee uniquely focused clinical studies with pioneering protocols and high-complexity medical terminology. This depth of understanding is particularly valuable in oncology, gene therapy, and rare disease.

The transition challenge: There’s often a catch-22 where entry-level positions require 1 to 3 years of clinical experience that doctoral students lack. To bridge this gap, many PhDs leverage specialized “industry-bridging” programs or GCP certifications to bypass the 2 to 4 years spent in lower-level administrative roles, potentially entering the field directly as a CRA or moving into medical affairs.

PhD salary advantage: Research Associates with PhDs command $85,000 to $180,000 depending on experience level. This premium exists because pharmaceutical sponsors value the scientific credibility and therapeutic expertise that comes with doctoral training, especially in complex therapeutic areas where the Goldilocks filter breaks down.

The Pendulum Will Swing

The “Goldilocks” trend (the rigid preference for CRAs with 2 to 3 years of experience) is a rational economic artifact of a commoditized, financialized, and increasingly automated industry. It’s the result of margin compression meeting algorithmic efficiency. By treating clinical monitoring as a standardized unit of production, CROs have optimized their short-term balance sheets.

However, this optimization is fragile. The exclusion of deep expertise has weakened the industry’s immune system, leaving it susceptible to regulatory infection and the opportunistic pathogens of fraud and diversion. The rising tide of FDA warning letters and the friction with powerful site networks suggest that the pendulum may eventually swing back as the hidden costs of “cheap” monitoring become undeniable.

The regulatory environment (ICH E6(R3)) is demanding more sophisticated oversight. Sponsors are complaining about quality. Site networks are refusing to work with junior monitors. The fraud cases are piling up. Something has to give.

Until that correction occurs, clinical research professionals must adapt. The path to career security no longer lies in being a loyal soldier who accumulates years of service. It lies in becoming a Specialist Weapon: mastering the niches (Gene Therapy, Oncology, Rare Disease), technologies (RBQM, AI-powered monitoring, DCT platforms), or oversight roles that the algorithm cannot replicate and the junior workforce cannot execute.

The industry may try to filter out experience, but it cannot filter out the necessity of competence.

I think it’s a race to the bottom unless the CROs can start doing high-value tech and really put the pieces together as far as globalization is concerned, which some of them have been. And some of the CROs are doing really good. But at the same time, I think they’re going to be losing market share to site networks.

The future of clinical research is not just about faster trials. It’s about smarter, more inclusive, and scientifically rigorous research that transforms laboratory discoveries into life-saving realities. And that requires the very expertise the industry is currently discarding.

What’s your experience with the Goldilocks window? Have you seen the quality impact firsthand? Have you been rejected for being “overqualified”? Have you successfully pivoted into one of these safe harbors? Reply and let me know. I’m collecting data on this trend.

The landscape is changing. There are opportunities. But you need to understand the game to play it effectively.

Here is my podcast on this topic, and if you made it this far, thank you.

Thanks for the write-up; agreed with a lot and learned quite a few new things as well. I’m in the middle of a transition from Senior CRA to CTM, and I can attest to drop in quality across the board. I hope to play a part in reversing that trend. I’m curious though to learn more about AI-based monitoring.